In Loving Memory

April 29, 1947 - September 5, 2020

Update: On Saturday, September 5th, 2020, the founder, administrator, and head moderator of this forum, Valerie S., went Home to be with the Lord. Her obituary can be found on https://memorials.demarcofuneralhomes.com/valerie-skrzyniak/4321619/index.php.

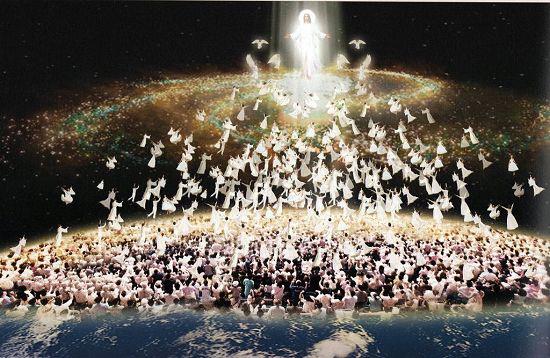

1 Thessalonians 4:15-18

For this we say unto you by the word of the Lord, that we which are alive and remain unto the coming of the Lord shall not prevent them which are asleep. For the Lord Himself will descend from heaven with a shout, with the voice of the archangel, and with the trump of God: and the dead in Christ shall rise first: Then we which are alive and remain shall be caught up together with them in the clouds, to meet the Lord in the air and so shall we ever be with the Lord. Wherefore comfort one another with these words.

2 Timothy 4:7-8

For I am already being poured out as a drink offering, and the time of my departure is at hand. I have fought the good fight, I have finished the race, I have kept the faith. Finally, there is laid up for me the crown of righteousness, which the Lord, the righteous Judge, will give to me on that Day, and not to me only but also to all who have loved His appearing .